How an outside scholarship works with your MIT Scholarship

Many MIT students receive outside scholarships. They come from a variety of sources: grants from your home state, a local business, non-profit organizations, employer tuition remissions/benefits, VA Benefits, the ROTC program, a National Merit Scholarship, or even a Pell Grant (which does not have its own application process). Any aid from a source other than MIT is considered an outside scholarship. The intent of these additional funds is that they be applied to your MIT education.

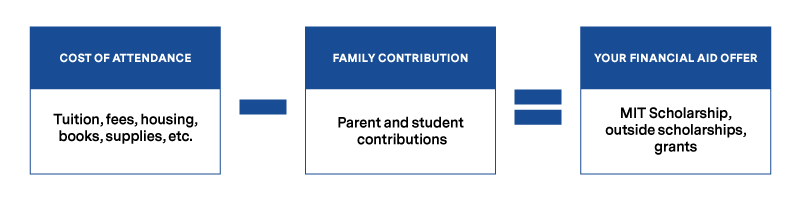

All of MIT’s financial aid is need based. This means that we offer aid entirely based on your family’s demonstrated financial need. In order to be equitable, we need to be consistent in what we ask all families to pay. An outside scholarship adds to what a family has available to pay, which affects a family’s calculated need. We do not offer families more financial aid than their calculated need.

With all that in mind, MIT first uses your outside scholarship to reduce or cover your student contribution (up to $5,400). Any additional money from your outside scholarship, beyond the amount of your student contribution, will reduce your MIT Scholarship. An outside scholarship cannot be used to reduce or cover the parent contribution.

Why an outside scholarship doesn’t reduce the parent contribution

All families are in different situations: some have many resources while others may have very little. Some families obtain resources through employment, while others obtain them through investment earnings, access to assets, or external scholarship funds.

MIT’s policy to cap financial aid at a student’s calculated need while allowing outside aid to also reduce the student contribution is embedded in our strong belief that need-based, rather than merit-based aid, is a more equitable way to distribute financial aid dollars. This allows MIT to maximize available funds for the families that need it most.

Once we calculate how much a family can afford to pay for college expenses—by taking account of their available resources—we take the difference between the family contribution and the total cost of attendance and cover the difference with financial aid. This is called meeting full need. By only offering need-based aid, we can use our resources in the most efficient way possible to support the financial need of all our students. Therefore, your outside scholarship, after reducing or covering the amount of your student contribution, must reduce your MIT Scholarship so that your total aid is not greater than your total demonstrated need or the total cost of attendance.

Please note: Families whose total income is less than $75,000, with typical assets, are not expected to contribute toward their student’s MIT education.

What you can do if your outside scholarship is more than your student contribution

If your outside aid, which includes the Pell Grant, is greater than your student contribution, we encourage you to contact your financial aid counselor. You may be able to use a portion of your outside scholarships toward the one-time purchase of a computer or to pay for the MIT Student Health Insurance Plan before reducing your MIT Scholarship. You may also want to contact your scholarship organization to see if they can postpone sending the funds for a future academic year that may be more advantageous.

All VA education benefits are treated like outside scholarships, including any housing and book stipends. Any additional money from your VA education benefits, beyond the amount of your student contribution, will reduce your MIT Scholarship.